Avoiding Boot in a 1031 Exchange

Simply put, boot is money or other property that is received or deemed received, but is not of a "like-kind" to the relinquished property (the real estate that is sold) or the replacement property (the real estate that is purchased) involved in the 1031 exchange.

When conducting a 1031 exchange transaction, investors generally want to avoid boot so they can avoid paying taxes on the value of the boot. Because it may be challenging to find a replacement property for the exact dollar amount of the relinquished property (resulting in boot which is taxable to the investor), it may be advantageous to identify more than one replacement property. An investor can identify up to three properties within the 45-day identification period to provide a tax deferral. Delaware statutory trusts, or DSTs, may be helpful in avoiding boot. Below is an illustrative example using a replacement property and two DSTs.

Avoiding Boot in a 1031 Exchange

Simply put, boot is money or other property that is received or deemed received, but is not of a "like-kind" to the relinquished property (the real estate that is sold) or the replacement property (the real estate that is purchased) involved in the 1031 exchange.

When conducting a 1031 exchange transaction, investors generally want to avoid boot so they can avoid paying taxes on the value of the boot. Because it may be challenging to find a replacement property for the exact dollar amount of the relinquished property (resulting in boot which is taxable to the investor), it may be advantageous to identify more than one replacement property. An investor can identify up to three properties within the 45-day identification period to provide a tax deferral. Delaware statutory trusts, or DSTs, may be helpful in avoiding boot. Below is an illustrative example using a replacement property and two DSTs.

Example of a Solution to Avoid Boot

RESULT: Investment into DSTs brought the value of all replacement properties to $2.0 million, providing full capital gains deferral to the investor.

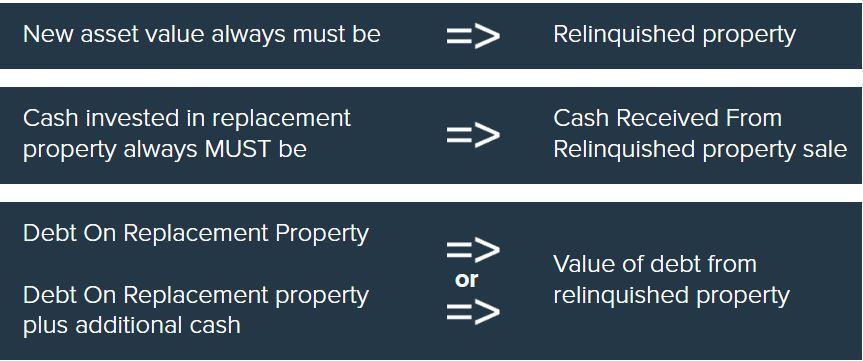

In general, an investor that wants to avoid paying taxes in a 1031 exchange transaction should look to purchase a "like-kind" replacement property with a value equal to or greater than the value of the relinquished property. Investors should also plan to reinvest all of the net sales proceeds from the sale of their relinquished property and make sure that either the debt on the replacement property is equal to or greater than the debt on the relinquished property, or, if the debt on the replacement property is less than the debt on the relinquished property, the investor funds the difference with their own cash.

Do's and Don'ts of a 1031 Exchange

Boot May Arise in these Common Situations in a 1031 Exchange Transaction

- Keeping some cash from the transaction. Cash sales proceeds received at the closing of the relinquished property that is not reinvested into replacement property will be considered boot.

- Sale proceeds used to pay non-closing expenses at closing. If sales proceeds are used to pay costs at closing that are not the type of closing expenses that can be used to offset sales proceeds during a 1031 exchange, then the result may be the same as if the investor received cash proceeds and used the cash proceeds to pay these costs. However, certain types of transaction and closing costs paid with cash proceeds offset cash boot received.

- Debt reduction. Debt reduction boot, also known as mortgage boot, occurs when the debt encumbering the replacement property, whether assumed or placed on the replacement property as part of the purchase, is less than the debt paid off or assumed by the purchaser with respect to the sale of the relinquished property. Debt reduction boot can occur when an investor is buying a replacement property that has an adjusted gross purchase price that is less than the adjusted gross sale price of the relinquished property.

Rules of offsetting boot

- Cash paid offsets cash boot received at the same closing table

- Cash paid offsets mortgage boot received

- Mortgage boot paid offsets mortgage boot received

- BUT an excess mortgage amount placed on or assumed with respect to the replacement property does not offset cash boot received

The rules regarding boot are complex and may vary with the facts and circumstances to each investor in an Inland Private Capital Corporation-sponsored 1031 exchange program. This communication does not constitute tax advice for any investor. Potential investors must consult with their own tax advisors.

Related Topics

This communication does not constitute tax advice for any investor. Potential investors must consult with their own tax advisors.

This website is neither an offer to sell nor a solicitation of an offer to buy any security, which can only be made by a private placement memorandum and sold only by broker dealers and registered investment advisors authorized to do so.

This material has been distributed by Inland Securities Corporation, member FINRA/SIPC, placement agent for programs sponsored by Inland Private Capital Corporation.