Not Sure Where to Find Real Estate Diversification?

Owning property in an investment portfolio provides a complementary source for potential return and income; however, most investors are not professionally trained with robust insights on real estate markets and sectors.

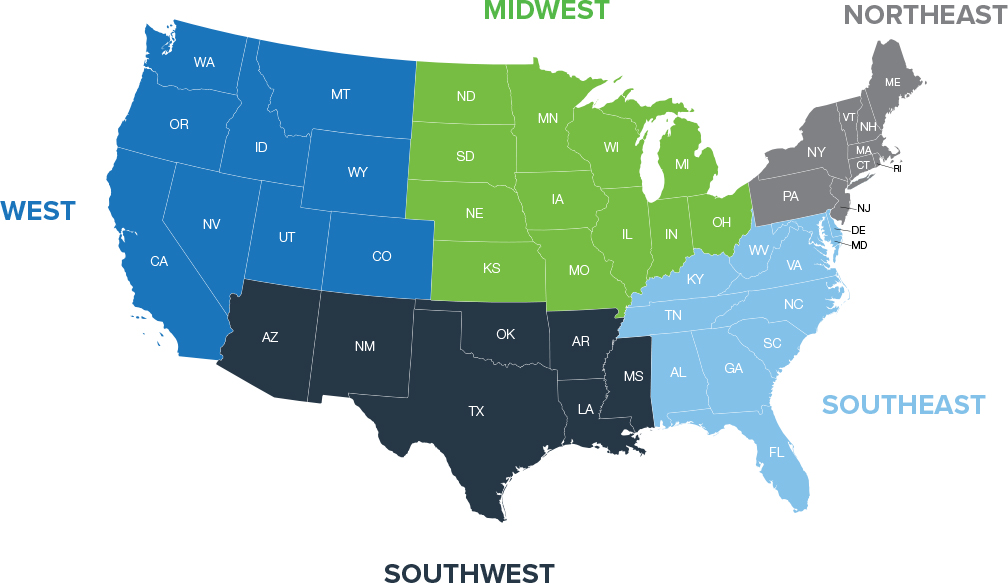

A Delaware statutory trust, or DST, is an investment structure in which multiple investors own fractional interests in a single property or portfolio of properties. Investors can gain access to institutional-quality property that may otherwise be out of reach. Using DSTs, investors can allocate assets to one or more DSTs, providing a more diversified real estate portfolio across geographic areas and property types.

DST offerings may be structured as a single property, a single geographic region or a combination of properties in a focused geography. For example, office properties in a major metropolitan city, self-storage properties in multiple locations, or a regional-based portfolio of properties.

Beneficial interests in DSTs are considered “like-kind” property for purposes of 1031 exchanges. In order to successfully execute a Section 1031 tax-deferred exchange, the replacement property must be like-kind to the relinquished property. Any real estate held for productive use in a trade or business or for investment purposes is considered like-kind. A primary residence would not fall into this category; however, vacation homes or rental properties may qualify.

Not Sure Where to Find Real Estate Diversification?

Owning property in an investment portfolio provides a complementary source for potential return and income; however, most investors are not professionally trained with robust insights on real estate markets and sectors.

A Delaware statutory trust, or DST, is an investment structure in which multiple investors own fractional interests in a single property or portfolio of properties. Investors can gain access to institutional-quality property that may otherwise be out of reach. Using DSTs, investors can allocate assets to one or more DSTs, providing a more diversified real estate portfolio across geographic areas and property types.

DST offerings may be structured as a single property, a single geographic region or a combination of properties in a focused geography. For example, office properties in a major metropolitan city, self-storage properties in multiple locations, or a regional-based portfolio of properties.

Beneficial interests in DSTs are considered “like-kind” property for purposes of 1031 exchanges. In order to successfully execute a Section 1031 tax-deferred exchange, the replacement property must be like-kind to the relinquished property. Any real estate held for productive use in a trade or business or for investment purposes is considered like-kind. A primary residence would not fall into this category; however, vacation homes or rental properties may qualify.

DSTs Can Offer Real Estate Diversification Across Property Types and Geographic Location

Inland Private Capital Corporation is recognized as an industry leader in 1031 exchange transactions.

Source: Mountain Dell Consulting 1031 DST/TIC Market Equity Update 2022 Year-End Report. Statement based on total equity raised.

8.50%

Weighted Average Annualized Rate of Return on Full-Cycle Programs*

Results by Asset Class

*Explanation of Terms & Calculations

Full-Cycle Programs are those programs that no longer own any assets. However, in certain limited situations in which the subject property(ies) were in foreclosure, IPC has negotiated with the lenders and advanced funds to the investors to allow the investors to exchange their beneficial interest in the original program for a proportionate beneficial interest in a new program, in order to continue their Section 1031 exchanges and avoid potential capital gains and/or forgiveness of debt tax liabilities. Because such exchanges result in an investment continuation, the original programs are not considered full-cycle programs for these purposes.

1Weighted Average Total Return (TR) For each full-cycle program, the TR is calculated by dividing the sum of amounts distributed to investors plus the net sale proceeds returned to the investors, by such investors’ capital invested in the program inclusive of all fees and expenses. To determine the weighted average Total Return in each asset class, the Total Return for each program within that asset class is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs within that asset class since inception (2001).

2Weighted Average Annualized Rate of Return (ARR) For each full-cycle program, the ARR is calculated by dividing (a) the sum of (i) total cash flows distributed during the term of the investment program, plus (ii) any net sales proceeds distributed less the investors’ original capital, by (b) the investors’ original capital; with the result then further divided by (c) the investment period (in years) for that program. To determine the weighted average in each asset class, the ARR for each program within that asset class is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs within that asset class since inception (2001).

Past performance is not indicative of future results.

Related Topics

This communication does not constitute tax advice for any investor. Potential investors must consult with their own tax advisors.

This website is neither an offer to sell nor a solicitation of an offer to buy any security, which can only be made by a private placement memorandum and sold only by broker dealers and registered investment advisors authorized to do so.

This material has been distributed by Inland Securities Corporation, member FINRA/SIPC, placement agent for programs sponsored by Inland Private Capital Corporation.