Zero Cash Flow DSTs

Zero Cash Flow DSTs

A Potential Solution to Cover 1031 Exchange Debt Requirements

Meeting the debt replacement requirement is an important aspect of the 1031 tax-deferred exchange transaction. In order to earn the tax benefits of a 1031 exchange, investors must invest at least all of the equity (proceeds) from the sale of the relinquished property into a replacement property. In addition, the sum of the cash invested and the debt placed on the replacement property must be equal to or greater than the sum of the cash invested and the debt placed on the relinquished property. Meeting the debt requirement is not always easy. Zero cash flow property investments, particularly in the form of Delaware Statutory Trusts (DSTs), provide investors with high debt requirements and a unique opportunity to continue down the tax deferral path.

Zero Cash Flow Properties

Zero Cash Flow Properties

Zero cash flow properties (zeros) are traditionally triple net leased (NNN) commercial real estate assets with well-established, credible tenants that hold investment-grade ratings. Zeros are highly leveraged – loan-to-value (LTV) at 80 to 90 percent – with long-term lease agreements As a result, all net operating income (NOI) generated by the property is used to pay the debt service obligation on the mortgage loan, and therefore provides no cash flow to the investor

The Use of Zeros in a 1031 Exchange

Hypothetical Example*

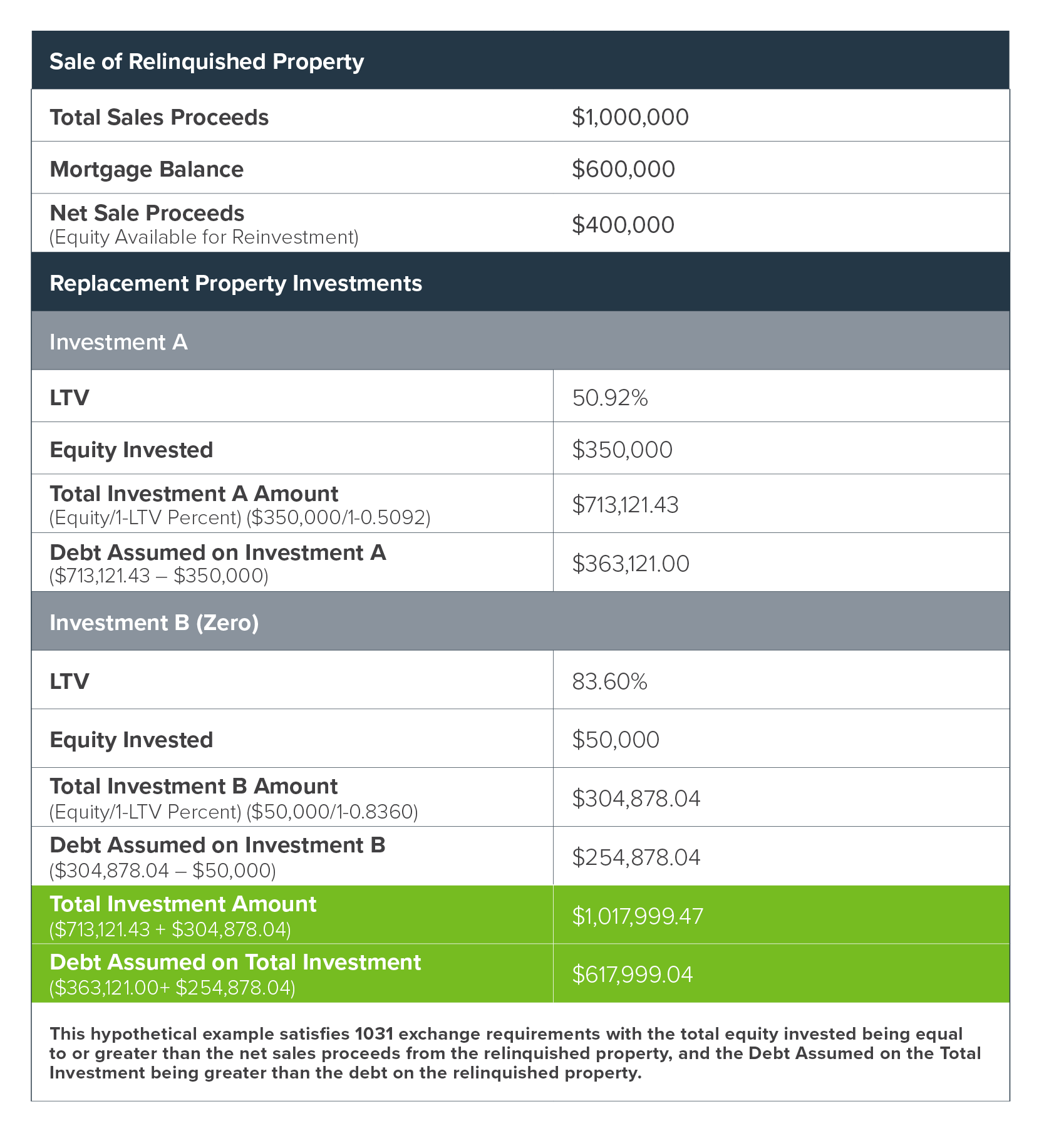

An investor is coming out of a moderately leveraged property sale with $400,000 equity left for reinvestment. To fulfill the debt requirement of the 1031 exchange and avoid tax implications, the sum of the cash invested and the debt placed on the replacement property must be equal to or greater than the sum of the cash invested and debt placed on the relinquished property. The investor chooses two replacement property investments, one with an average LTV, the second is a zero cash flow investment with a high LTV. Here’s how a zero would be utilized to meet this investor’s needs.

*Note this is a simplified example intended to solely illustrate the way in which a zero cash flow property investment can satisfy the debt requirements of a 1031 exchange transaction and is not intended to provide a recommendation of investment or to provide tax advice.

Keep the above hypothetical example handy for discussions on how zeros can help address the 1031 exchange debt requirement by downloading the PDF version.

The Use of Zeros in a 1031 Exchange

While zeros do not provide current income for investors, they can be an attractive investment vehicle to cover the debt replacement requirement of a 1031 exchange. Investors that have little or no equity left from the sale of a relinquished property and are looking to satisfy the debt requirement of a 1031 exchange may utilize a zero to acquire real estate with as little equity as possible.

Hypothetical Example*

An investor is coming out of a moderately leveraged property sale with $400,000 equity left for reinvestment. To fulfill the debt requirement of the 1031 exchange and avoid tax implications, the sum of the cash invested and the debt placed on the replacement property must be equal to or greater than the sum of the cash invested and debt placed on the relinquished property. The investor chooses two replacement property investments, one with an average LTV, the second is a zero cash flow investment with a high LTV. Here’s how a zero would be utilized to meet this investor’s needs.

Additional Advantages of Zeros

Sale of Relinquished Property

(Equity Available for Reinvestment)

Replacement Property Investments

Investment A

(Equity/1-LTV Percent) ($350,000/1-0.5092)

($713,121.43 - $350,000)

Investment B (Zero)

(Equity/l-LTV Percent) ($50,OOO/1-0.8360)

($304,878.04 - $50,000)

($713,121.43 + $304,878.04)

($363,121.00 + $254,878.04)

This hypothetical example satisfies 1031 exchange requirements with the total equity invested being equal to or greater than the net sales proceeds from the relinquished property, and the Debt Assumed on the Total Investment being greater than the debt on the relinquished property.

*Note this is a simplified example intended to solely illustrate the way in which a zero cash flow property investment can satisfy the debt requirements of a 1031 exchange transaction and is not intended to provide a recommendation of investment or to provide tax advice.

Keep the above hypothetical example handy for discussions on how zeros can help address the 1031 exchange debt requirement by downloading the PDF version.

DOWNLOAD PDF

Related Topics

This communication does not constitute tax advice for any investor. Potential investors must consult with their own tax advisors.

This website is neither an offer to sell nor a solicitation of an offer to buy any security, which can only be made by a private placement memorandum and sold only by broker dealers and registered investment advisors authorized to do so.

This material has been distributed by Inland Securities Corporation, member FINRA/SIPC, placement agent for programs sponsored by Inland Private Capital Corporation.

1031 Exchange Calculator

This tool is designed to evaluate different scenarios when exchanging into multiple real estate options.

Related Topics

This communication does not constitute tax advice for any investor. Potential investors must consult with their own tax advisors.

This website is neither an offer to sell nor a solicitation of an offer to buy any security, which can only be made by a private placement memorandum and sold only by broker dealers and registered investment advisors authorized to do so.

This material has been distributed by Inland Securities Corporation, member FINRA/SIPC, placement agent for programs sponsored by Inland Private Capital Corporation.